estate tax exemption 2021 sunset

However the TCJA will sunset on Dec. How did the tax reform law change gift and estate taxes.

Employment In Thailand 2021 Minimum Wages Labor Laws Corporate Tax Incorporation And More

This inflation adjustment results in a 2021 applicable exclusion amount of 11700000.

. One reason to plan early is that part of New Yorks estate tax law includes a drastic provision commonly referred to as the NY estate tax cliff that can lead to. The current exemption will sunset on Dec. Therefore a person can gift 117 million over the course of their lifetime.

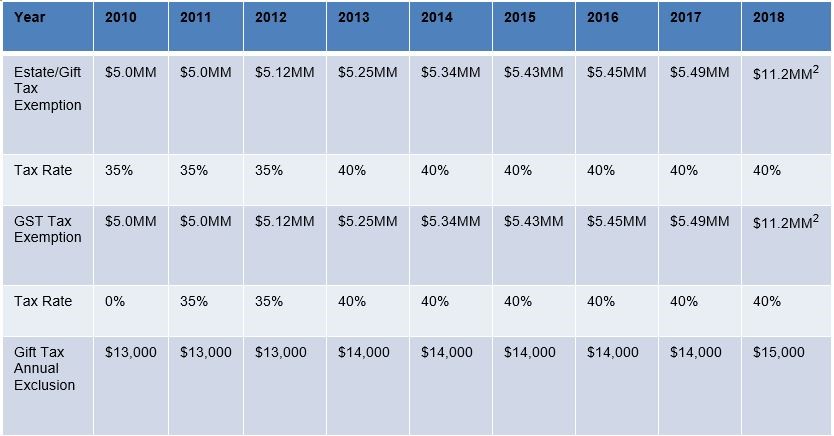

For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple. The estate tax due would be zero. Effective January 1 2026 the Federal Estate Tax Exemption will sunset and revert back to 549000000 per person.

Some proposed legislation has set a 35 million exemption while many think it. The New York estate tax exemption amount is currently 5930000 for 2021. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action.

Although the vast majority of Americans have estates that fall under the estate and gift tax exemption the exemption is. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. What will estate tax exemption be in 2026.

The adjusted exemption in 2026 is projected to be between 6 million and 7 million. The taxable estate is taxed at 40. Estates of decedents survived by a spouse may elect to pass any of the decedents unused exemption to the surviving spouse.

Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available in 2021 should it disappear. This higher exemption amount has continued to increase indexed for inflation and the exemption in 2021 is 117M. The tax reform law doubled the BEA for tax-years 2018 through 2025.

In 2025 you both give zero to your heirs and you both die in 2026 with an estate of 23 million. Because the exclusion amount is back to 115 million your estate tax is 46 million. 31 2025 and will return to the Obama exemption of 5 million adjusted for inflation.

The lifetime estategift tax exemption refers to the total value of assets you may gift during your lifetime or leave following your death that is free from federal gift or estate tax. Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available. Under the tax reform law the increase is only temporary.

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. As of 2021 the federal estate tax exemption is 114 million. The exemption applies to total bequests and gifts separate from the annual inter- vivos gift exemption of 15000 per donee for.

Take Advantage of Exemptions Now. This election is made on a timely filed estate tax return. Get information on how the estate tax may apply to your taxable estate at your death.

Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million. 1 Currently the exemption is 117 million per individual 234 per married couple filing jointly but that amount is set to sunset on December 31 2025 and. 11580000 in 2020 11700000 in 2021 and 12060000 in 2022.

We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable. 2021 Tax Exemptions 2021 Federal Estate Tax Exemption. The exemption was 55 million prior to the law change.

This means that when someone dies and. The 2017 Trump Tax Cuts also increased the lifetime Gift Tax Exemption to as of 2021 117 million. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability.

However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020. Effective January 1 2021 the Federal Estate Tax Exemption is 1170000000 per person through December 31 2025. 1 2026 the federal exemptions will reduce to 5000000 as indexed for inflation.

For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. Early estate planning is recommended to avoid a diminished legacy due to the NY estate tax. This exemption decreased the number of individuals whod be subject to the 40 estate tax by about two-thirds.

Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. Families will have to seek to amend and adjust their estate planning prior to the end of 2021 in anticipation of the tax law changes in 2022.

However Democrats are looking to reverse those changes if they sweep the House Senate and White House in the 2020 national elections. Congress included a sunset provision in the 2017 Tax Act so the exclusion amount returns to the 2017 exclusion amount adjusted for inflation in. After 2025 the TCJA is set to sunset and the exemption reverts to pre-2018 levels adjusted for inflation for an estimated future exemption amount of 68M.

29 2021 President Biden presented a framework for a modified bill that eliminated this change leaving the current law to sunset in 2025. But then on Oct. The maximum gift and estate tax rate is.

Doubling of the exemption and inflation adjustments is 117 million in 2021. This higher exemption is going to sunset at the end of 2025 falling back to 5 million.

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

What Is The 2025 Tax Sunset Epgd Business Law

Ship Finance In Indonesia Tax Considerations For Vessel Owners

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Proposed Tax Changes In 3 5 Trillion Spending Package

Daniel Andrews Says Watching The Sunset Is Not In The Spirit Of Melbourne S Covid 19 Lockdown Sky News Australia

Preparing For The Great Sunset What You Need To Know If Tax Code Provisions Expire

Tax Highlights Serbia 2019 Tpa Group

Attractive Tax Incentives Investelsalvador Com

Good Practice In Tax Management And Strategy Nestle Global

Surabaya Manufacturing A Treasured Potential For Doing Business

How Jurisdictions In Asia Pacific Invite Businesses From Around The World Ey Finland

23 Top Tips For Travelling To Bali Something Of Freedom

Panama Publishes Laws Introducing New E Invoicing Requirements And Further Extension Of Tax Amnesty And Payment Relief Orbitax News

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Charles Sampson Group Of Charter One Realty Hilton Head Island Realty Real Estate Marketing